Robust Mean - Variance Portfolio¶

Consider the problem of allocating to allocate a capital over multiple assets to maximize portfolio’s expected return, while ensuring a very low probability that the actual return falls below the computed value. This approach addresses the inherent uncertainty in portfolio returns, making it a robust optimization problem.

In the example taken from [1, Section 3.4], we have \(n = 200\) assets. Let \(r_i\) denote the return, and \(\sigma_i\) denote the standard deviation associated with the \(i\)-th asset. The last asset represents cash, so we set its return to \(r_{n}=1.05\) and standard deviation to \(\sigma_n = 0\). The returns of the remaining assets \(r_i\), for \(i=1,\dots, n-1\), are random variables taking values in the intervals \([\mu_i - \sigma_i ,\mu_i + \sigma_i ]\). The vectors \(\mu\) and \(\sigma\) are defined as

To solve this problem, we first import the required packages and generate the data.

[2]:

import lropt

import cvxpy as cp

import numpy as np

import matplotlib.pyplot as plt

import pandas as pd

[4]:

n = 200

cash_return = 1.05

#Define mu

mu = np.zeros(n)

mu[-1] = cash_return

for i in range(n - 1):

mu[i] = cash_return + 0.3 * (n - i) / (n- 1)

#Define sigma

sigma = np.zeros(n)

for i in range(n - 1):

sigma[i] = 0.05 + 0.6 * (n - i) / (n - 1)

The problem we want to solve is the uncertain linear optimization problem of the form

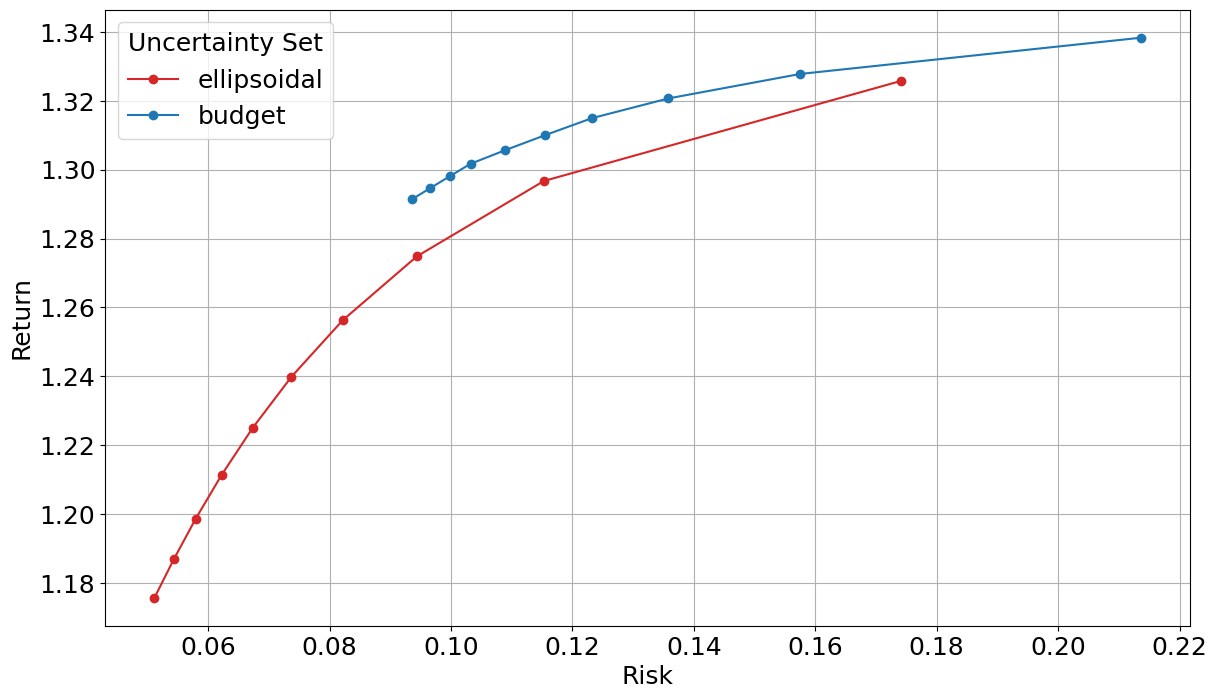

where \(x_i\) is the normalized capital to be invested in asset \(i\), and \(r\) is the uncertain vector of returns. We model the uncertain returns as \(r_i = \mu_i + \sigma_i z_i\) for \(i=1,\dots,n\), where \(z = (z_1,\dots,z_n)\) is a vector of uncertain parameters. In the following snippet, we solve this problem using Ellipsoidal and Budget uncertainty sets of the form:

for different values of the set radius \(\rho\).

[31]:

names = ['Ellipsoidal', 'Budget']

rho_values = np.linspace(0.1, 2.0, 10) # Range of rho values

uncertainty_sets = {

'ellipsoidal': lambda rho: lropt.Ellipsoidal(rho=rho, b=mu, a=np.diag(sigma)),

'budget': lambda rho: lropt.Budget(rho1=rho, rho2=rho, b=mu, a=np.diag(sigma))

}

results = {}

for uc_name, uc in uncertainty_sets.items():

results_uc = []

for rho in rho_values:

t = cp.Variable()

x = cp.Variable(n)

r = lropt.UncertainParameter(n, uncertainty_set=uc(rho))

constraints = [

r @ x >= t,

cp.sum(x) == 1,

x >= 0

]

objective = cp.Maximize(t)

prob = lropt.RobustProblem(objective, constraints)

prob.solve()

optimal_allocation = x.value

optimal_return = t.value

# Estimates of covariance and risk based on simplified model

cov_matrix = np.diag(sigma ** 2)

variance = np.dot(optimal_allocation.T, np.dot(cov_matrix, optimal_allocation))

risk = np.sqrt(variance)

results_uc.append({

'rho': rho,

'return': optimal_return,

'risk': risk

})

results[uc_name] = pd.DataFrame(results_uc)

The following code creates a graph of the tradeoff curve of risk and return over a range of values of \(\rho\).

[32]:

plt.figure(figsize=(14, 8))

plt.rcParams.update({"font.size": 18})

colors = ['tab:red', 'tab:blue']

for idx, uc in enumerate(uncertainty_sets.keys()):

plt.plot(results[uc]['risk'], results[uc]['return'], color=colors[idx], marker='o', label=uc)

plt.xlabel('Risk')

plt.ylabel('Return')

plt.legend(title='Uncertainty Set')

plt.grid(True)

plt.show()

References¶

Bertsimas, Dimitris, and Dick Den Hertog. Robust and Adaptive Optimization. [Dynamic Ideas LLC], 2022.